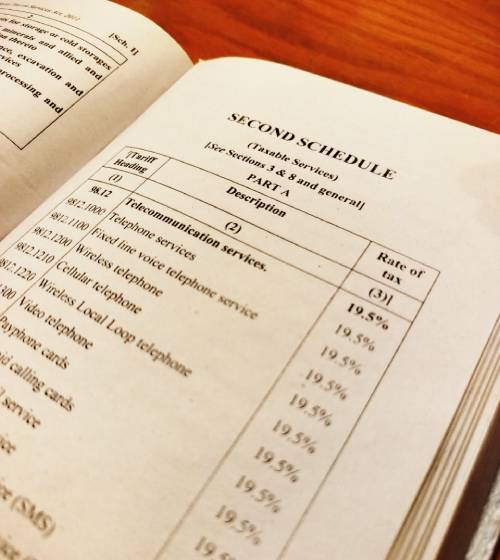

Taxable Services

Taxable Services for the purposes of levy and collection of Sindh sales tax are listed in Second Schedule to the Sindh Sales Tax on Services Act, 2011. Sindh-based taxpayers are encouraged to view this list, immediately register with Sindh Revenue Board in case their economic activity falls in the scope of the list and start regularly paying their sales tax returns. General rate of Sindh sales tax on services is 13% with the exception of telecommunication services, which are liable to be taxed at 19.5%. Tax is levied at reduced or concessionary rates in certain cases. The taxable services which are conditionally or otherwise exempt from tax are also notified by SRB.

Taxable Services

Sindh Revenue Board (SRB) Head Office, 3rd Floor, Shaheen Complex, M. R. Kiyani Road, Karachi.